-

Unit set up by J&J for talc cases loses bankruptcy protection

-

Company says it will challenge the appeals court ruling

Johnson & Johnson can’t use bankruptcy to resolve more than 40,000 US cancer lawsuits over its now-withdrawn baby powder, a federal appeals court ruled.

The three-judge panel in Philadelphia sided with cancer victims, who argued J&J wrongly put its specially created unit, LTL Management, under court protection to block juries around the country from hearing the lawsuits and handing out damage awards.

The ruling means J&J will most likely need to defend itself against claims that tainted talc in its baby powder causes cancer. The company has lost a number of such cases — including one that was appealed all the way to the US Supreme Court, before J&J was forced to pay more than $2 billion to one group of victims.

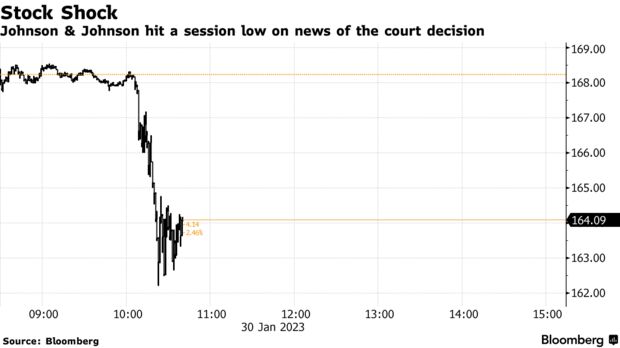

Shares of J&J dropped as much as 7.2% in New York on Monday before closing down 3.7%. J&J removed its iconic talc-based baby powder from the US market in 2020 and is slated to have it off markets across the globe by the end of this year.

The judges found only companies directly threatened with financial troubles can use bankruptcy. Since J&J itself never claimed to be in immediate danger, it can’t benefit from Chapter 11 of the bankruptcy code by putting a unit under court protection, the judges found.

“Good intentions — such as to protect the J&J brand or comprehensively resolve litigation — do not suffice alone,” to file for bankruptcy, Judge Thomas Ambro wrote. “What counts to access the Bankruptcy Code’s safe harbor is to meet its intended purposes. Only a putative debtor in financial distress can do so. LTL was not. Thus we dismiss its petition.”

The ruling may drive a settlement, according to Holly Froum, a litigation analyst for Bloomberg Intelligence. A settlement of the more-than 40,000 suits could total $5 billion, according to Froum, who in a note Monday pegged the chances of a deal at 70%.

J&J plans to challenge the ruling. The bankruptcy was filed in good faith to “equitably resolve” talc claims, it said in a statement. If the company’s appeals aren’t successful, plaintiffs’ lawyers predicted Monday J&J could face a wave of talc trials starting this summer.

J&J can now ask that all judges on the Philadelphia appeals court hear their appeal of the three-judge panel’s decision. If that’s denied, the company has the right to ask the US Supreme Court to hear its arguments that the Chapter 11 case should be allowed to proceed.

“The doors to the courthouse, which had been slammed shut by J&J’s cynical legal strategy, are once again open,” said Leigh O’Dell, a lawyer representing thousands of talc users whose claims have been consolidated in New Jersey for pre-trial information exchanges. Plaintiff lawyers will be scrambling to get talc suits back on trial dockets across the US in the wake of the appeals court’s ruling, O’Dell said.

A J&J lawyer Monday indicated the company was preparing for more talc litigation in a trial against consumer-products maker Colgate-Palmolive Co. Allison Brown, one of Colgate’s attorneys who has represented J&J in past talc cases, asked a California judge to put on hold Francis Coit’s case against multiple defendants over injuries allegedly tied to talc-based powders.

“Given plaintiff’s allegations in the complaint about Johnson’s Baby Powder, and that if they are permitted to do so, they will seek to bring J&J into the complaint, Colgate would request a continuance, Your Honor, to see what happens with the J&J bankruptcy and if J&J truly will need to come into this case to defend itself against the allegations” against its baby powder, Brown told Judge Richard Sebolt, according to a copy of a court transcript.

The bankruptcy case had put all talc litigation on hold while the appellate court decided whether the so-called Texas-Two Step technique J&J relied on for its talc bankruptcy was flawed.

Texas Two-Step

After several talc litigation losses, J&J turned to the maneuver, which is designed to block the cases from trial and force claimants to negotiate in the Chapter 11 case of LTL.

In 2021, the health-care giant sought to funnel the suits into what it acknowledged was a “shell company” without any operations. That unit, LTL, immediately filed for bankruptcy to block the litigation while trying to negotiate settlements.

J&J has long argued that there is no good scientific evidence linking its baby powder to cancer. The company argued LTL’s case was the only way of managing talc litigation costs and ensuring victims get a fair payment.

US Bankruptcy Judge Michael Kaplan, who is based in Trenton, New Jersey — not far from J&J’s headquarters in New Brunswick — ruled last year that LTL’s bankruptcy was legitimate and a better solution than continuing to have juries weigh claims nationwide. Cancer claimants appealed Kaplan’s decision.

A handful of companies, including Koch Industries’ Georgia-Pacific unit, used the strategy before J&J. Those cases remain in bankruptcy court in North Carolina. The Philadelphia court’s decision will not have any direct impact on the North Carolina cases.

Last year, a bankruptcy judge in Indianapolis refused to halt about 230,000 lawsuits against 3M Co. even though its subsidiary, Aearo Technologies, had filed a legitimate Chapter 11 case. 3M has appealed that decision.

LTL’s bankruptcy was the first Texas Two-Step to reach an appeals court. After victim groups challenged Kaplan’s ruling, the appeals court in Philadelphia agreed to expedite the case.

J&J’s strategy has been condemned by some legal scholars and members of Congress because the company received a major benefit of Chapter 11 rules — a halt to lawsuits — without filing for bankruptcy, where it would be subject to court oversight of its spending and other practices.

The handful of the companies that have used the strategy since it emerged in 2017 have faced suits targeting their use of asbestos, a toxic industrial material. The cases take advantage of special rules set up by Congress for companies threatened with insolvency by such litigation.

There have been ongoing talks aimed at settling the talc cases filed in both state and federal courts. Prior to J&J putting its unit into bankruptcy in 2021, the company offered to resolve the suits as much as $5 billion, according to Monday’s decision.

In Chapter 11 filings, J&J’s lawyers acknowledged the LTL subsidiary had a value of more than $61 billion and those funds could be tapped to satisfy talc liabilities, if necessary. Analysts, however, aren’t predicting the company will pay out anything near that figure to settle the cases.

The J&J bankruptcy case is LTL Management LLC, 21-30589, U.S. Bankruptcy Court, District of New Jersey (Trenton).