In this blog post, I look at the history of this derivative that is lately gaining more and more exposure in media. I have done several videos and posts on the topic in the past. Still, I thought it would be necessary for the current market climate that we take a closer look at the “Insurance”/Bet derivative that blew up AIG in the 2007-8 financial crisis.

A credit default swap (CDS) is a financial derivative that allows investors to hedge or speculate on the credit risk of a particular debt instrument, typically a bond or loan. It functions as a form of insurance wherein one party (the protection buyer) pays a premium to another party (the protection seller) in exchange for protection against the default of a third-party debtor (the reference entity). In the event of default by the reference entity, the protection seller compensates the protection buyer for the loss. Credit default swaps have been widely used in global financial markets since the late 1990s.

History of Credit Default Swaps:

The concept of credit default swaps can be traced back to the early 1990s when they were first developed by J.P. Morgan’s Blythe Masters and her team. In order for a CDS not to be regulated under the strict regulation of insurance corporations, they named it Credit Default Swap instead of insurance. The first CDS transaction occurred in 1994 between J.P. Morgan and the European Bank for Reconstruction and Development. The deal was designed to hedge J.P. Morgan’s exposure to Exxon’s credit risk following the Exxon Valdez oil spill in 1989.

The market for CDS snowballed in the late 1990s and early 2000s as financial institutions recognized their potential to hedge and manage credit risk more efficiently. The increasing demand for credit protection and the ease of trading CDS contracts led to the rapid expansion of the market. As the market developed, various types of credit default swaps emerged, such as single-name CDS, which are linked to a single reference entity, and index CDS, which are linked to a basket of reference entities.

One of the key drivers behind the growth of the CDS market was the rise of structured finance products, such as collateralized debt obligations (CDOs). These products allowed banks and other financial institutions to repackage and sell their loan portfolios, thus transferring credit risk to investors. Credit default swaps were often used to hedge the credit risk associated with these structured products, further fueling their growth.

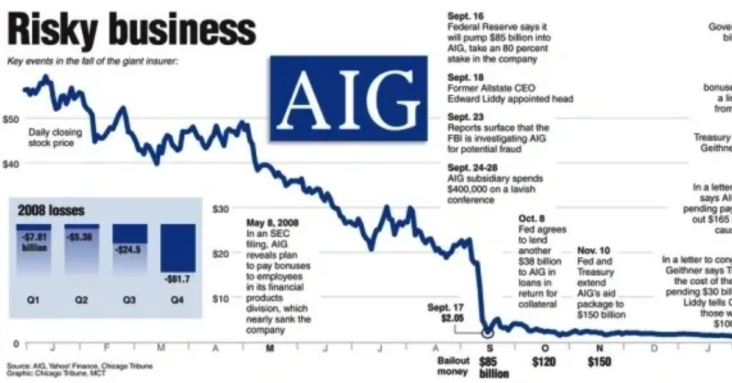

The CDS market played a significant role in the 2007-2008 global financial crisis. The widespread use of CDS contracts to hedge and speculate on mortgage-backed securities (MBS) and CDOs contributed to the buildup of systemic risk in the financial system. When the U.S. housing market collapsed, and default rates on subprime mortgages surged, the CDS market experienced a chain reaction of defaults and losses. This led to the collapse of several major financial institutions, most notably Lehman Brothers and American International Group (AIG).

In the aftermath of the financial crisis, regulators and policymakers worldwide implemented various reforms to reduce the systemic risk posed by the CDS market. These reforms included increased transparency, central clearing of standardized CDS contracts, and higher capital requirements for banks that engage in CDS trading. These reforms aimed to increase the financial system’s stability and prevent a repeat of the 2008 crisis.

Despite the regulatory changes, the credit default swap market remains an essential tool for investors to hedge and manage credit risk. The market has evolved since the financial crisis, shifting towards more standardized and transparent products. Today, CDS contracts are primarily traded on electronic platforms, which provide greater price transparency and facilitate regulatory oversight.

Facts about Credit Default Swaps:

- Credit default swaps are insurance contracts that allow investors to hedge or speculate on the credit risk of a particular debt instrument, such as a bond or loan.

- The protection buyer pays a premium, usually expressed as a percentage of the notional amount of the debt instrument, to the protection seller in exchange for protection against the default of the reference entity.

- In the event of default by the reference entity, the protection seller is obligated to compensate the protection buyer for the loss incurred, usually by paying the difference between the face value of the debt instrument and its recovery value.

- The CDS market has grown significantly since its inception in the 1990s, driven by the clearing of standardized CDS contracts and higher capital requirements for banks that engage in CDS trading. These reforms aimed to increase the financial system’s stability and prevent a repeat of the 2008 crisis.

Despite the regulatory changes, the credit default swap market remains an essential tool for investors to hedge and manage credit risk. The market has evolved since the financial crisis, shifting towards more standardized and transparent products. Today, CDS contracts are primarily traded on electronic platforms, which provide greater price transparency and facilitate regulatory oversight.

In recent years, investors have shown interest in the following types of CDS:

- Sovereign CDS: These swaps allow investors to hedge or speculate on the credit risk of sovereign debt issued by countries. Sovereign CDS gained prominence during the European sovereign debt crisis, which affected countries like Greece, Portugal, and Italy. In 2021, investors might have continued to use sovereign CDS to manage their exposure to the credit risk of countries facing economic challenges or political instability.

- Corporate CDS: Investors use corporate CDS to hedge or speculate on the credit risk of specific companies. In 2021, investors might have been interested in the credit risk of companies in sectors that were heavily affected by the COVID-19 pandemic, such as the travel and hospitality industries, or companies that faced financial challenges due to changing market conditions or other factors. Conversely, investors might also have sought credit protection for companies that performed well during the pandemic, such as technology and e-commerce firms.

- Index CDS: Index CDS allows investors to hedge or speculate on the credit risk of a basket of reference entities, usually grouped by sector, region, or credit rating. Investors might have focused on index CDS representing sectors heavily impacted by the pandemic, such as energy, retail, or commercial real estate. Index CDS provide a more diversified exposure to credit risk, which can appeal to investors looking to manage their overall portfolio risk.

- Emerging market CDS: As global investors seek higher returns, they often look to emerging markets, which typically carry higher risks. In 2021, investors might have used CDS to hedge their exposure to emerging market debt, particularly in countries facing economic headwinds, political instability, or other challenges.

What happens when a Credit Default Swap is initiated and purchased, and what are the potential outcomes from that contract?

- The protection buyer and protection seller enter into a CDS contract.

- The protection buyer pays periodic premiums to the protection seller.

- Reference entity and reference obligation determine the underlying credit risk exposure.

- Monitor for a credit event (e.g., bankruptcy, failure to pay, or restructuring).

- If a credit event occurs, proceed to settlement through physical or cash settlement.

- If no credit event occurs, the CDS contract expires, and no further action is taken.

In conclusion, credit default swaps have played a significant role in the global financial landscape since their inception in the 1990s. They have enabled investors to manage credit risk more efficiently and contributed to the growth of structured finance products. However, the 2007-2008 financial crisis exposed the dangers associated with the widespread use of CDS contracts and the potential for systemic risk.