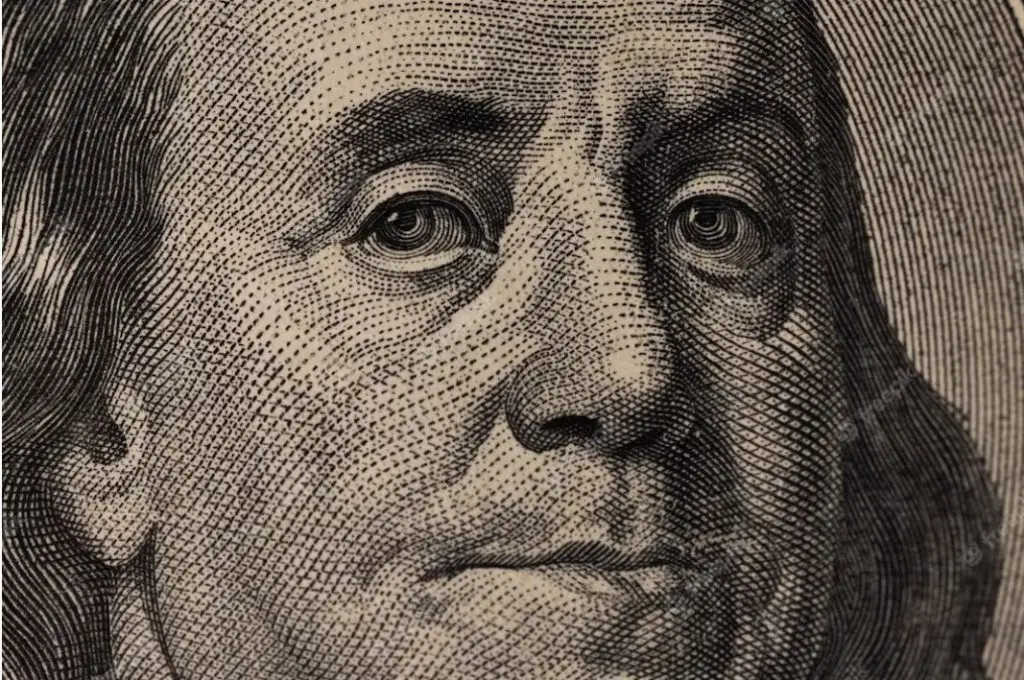

The U.S. economy is on a slippery slope as the debt ceiling crisis could send the markets crashing. The discretionary spending could make the markets plunge and other countries holding the U.S. dollar as reserves might face a recession. Additionally, talks of the BRICS alliance launching a new currency could spell trouble for the prospects of the U.S. dollar. A handful of financial sectors in the U.S. earn profits as the world transacts in the USD for goods and services.

If the new BRICS currency gains trust and strengthens itself in the global markets, the U.S. dollar could be on a path of decline. Also, the U.S. will have no means to fund its deficit making the American economy weaker on the international stage. Several financial sectors in the U.S. could be affected leading to a domino effect of economic crisis.

BRICS: 8 Financial Sectors In the U.S. Could Be Hit If the New Currency Gains Strength

Currently, around eight financial sectors in the U.S. could be affected if BRICS launch their new currency in the markets. The U.S. sectors that could be impacted by the formation of the new BRICS currency are:

- Banking and Finance

- Oil and Gas

- Commodities

- Production and Consumption

- Technology

- Tourism and Travel

- The Foreign Exchange Market

- International Trade

All these sectors are closely linked with the U.S. dollar and any shift in the geopolitical dynamics could shake up the industries. Moreover, if banking and finance take a hit, the shot could spill over into the commodities markets. Similarly, the domino effect could fall on the foreign exchange and international trade making the U.S. dollar difficult to balance its status.

Additionally, a decline in the U.S. dollar’s power could cause a reduction in production and consumption. Nonetheless, if the BRICS currency is used to settle the oil and gas trade, the U.S. dollar could be hit. Therefore, the fate of the dollar and the American economy could be decided by how well the BRICS alliance positions its new currency.