Many observers speculate that Putin invaded Ukraine because he wanted to prevent NATO from expanding to Russia’s border. He felt increasingly threatened by a Ukrainian government formed in the aftermath of a 2014 Obama-backed coup. It is highly unlikely that Vladimir Putin invaded Ukraine without first receiving the approval of China’s Xi Jinping.

What did Vladimir Putin and Xi Jinping think Western Nations would do in response to Russia’s invasion of Ukraine? The United States and the European Union would most likely refuse to join a kinetic war against the world’s greatest nuclear power. Therefore, they would be limited to sending military aid, imposing economic sanctions, and at the very most, excluding Russia from the SWIFT financial system.

These types of economic sanctions were predictable because this is exactly how the West responded when Russia took the Crimean Peninsula from Ukraine in 2014. Strategically, Putin chose to invade now because the U.S. and E.U. would be incapable of mounting a more serious response at the end of the global long-term debt cycle when their economies faced record high-debt levels, the highest inflation in 40-years, and supply chain shortages fomented by lockdown policies implemented in response to covid-19.

In other words, Russia and China may have not only predicted this outcome, but they may have wanted this exact outcome to transpire because their ultimate goal wasn’t simply to annex Ukraine. Their ultimate goal has always been to displace the U.S. at the apex of the global pyramid, and therefore, to end the role of the dollar as the global reserve currency.

For more than a decade, China and Russia have sought to reduce their use of the U.S. dollar or to “de-dollarize” their economies, in an effort to shield their economies from U.S. sanctions, reduce exposure to the effects of U.S. economic and monetary policy, and assert global economic leadership.

In 2015, 90 percent of China and Russia’s bilateral trade settlements were conducted in dollars. By 2020, only 46 percent of their bilateral transactions were conducted in dollars. While removing Russia from SWIFT will hurt Russia’s economy in the short term, it will also serve the purpose of greatly accelerating this process of global de-dollarization.

Founded in 1973, Belgium-based SWIFT is used by banks globally for cross-border financial transactions. It facilitates trillions of dollars of cross-border payments between 11,000 financial institutions in more than 200 countries making it the backbone of the international financial transfer system.

In 2014, Russia launched the System for Transfer of Financial Messages (SPFS), a Russian alternative to SWIFT. In 2015, China launched the Cross-Border Interbank Payment System (CIPS), a Chinese alternative to SWIFT. CIPS processed around $12.68 trillion in 2021, a 75% increase from 2020. CIPS has about 1,280 financial institutions in 103 countries and regions connected to their system.

Combine the Russian System for Transfer of Financial Messages (SPFS) with the Chinese Cross-Border Interbank Payment System (CIPS) and you see the foundation of a new Russian-Chinese cross-border payment system bypassing SWIFT and speeding up global de-dollarization.

A Bloomberg article sums up the western financial system’s collective fears:

“Booting Russia from the critical global system – which handles 42 million messages a day and serves as a lifeline to some of the world’s biggest financial institutions – could backfire, sending inflation higher, pushing Russia closer to China, and shielding financial transactions from scrutiny by the west. It might also encourage the development of a SWIFT alternative that could eventually damage the supremacy of the US dollar.”

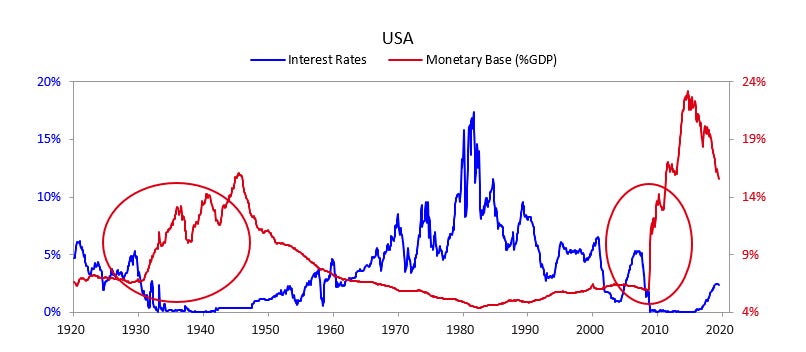

Why now? This is all happening at the late stages of something that I have written extensively about called the long-term debt cycle. A time period characterized by high-debt levels, near-zero interest rates, and extreme money printing.

When interest rates hit the floor at zero marks the beginning of the end of the long-term debt cycle and the start of a deleveraging period where central bankers begin to devalue their currencies.

With interest rates at zero, policymakers only have two remaining options; quantitative easing (printing money and buying financial assets) or printing money and putting it directly into the hands of people in the form of stimulus payments.

For example, both the 2008-2009 Global Financial Crisis and the 1929-1933 Great Depression coincide with interest rates hitting the zero percent floor. In response to both, the Federal Reserve printed money, devalued the dollar, and bought financial assets. This currency devaluation period ends when inflation rises and central bankers can no longer print money or keep interest rates at zero.

In response to covid-19, the Federal Reserve increased its total assets from $4.1 trillion in January 2020 to $8.3 trillion as of August 2021. This historic level of money printing has led to US inflation reaching its highest level in 40-years.

This inflation has only been exacerbated by policymakers who have driven the price of energy up by canceling the Keystone XL pipeline, banning new gas and oil drilling on federal land, and increasing American energy dependence on foreign imports.

Russia chose to invade Ukraine as U.S. government debt crossed $30 trillion for the first time and the Federal Reserve faces a 40-year high in inflation coinciding with the end of the long-term debt cycle. They also chose this time to invade because U.S. and E.U. policymakers have chosen to become increasingly dependent on Russian gas and oil.

Russia is one of the world’s largest exporters of oil with the United States importing more than 600,000 barrels per day. Russian oil represents more than a third of Europe’s total imports.

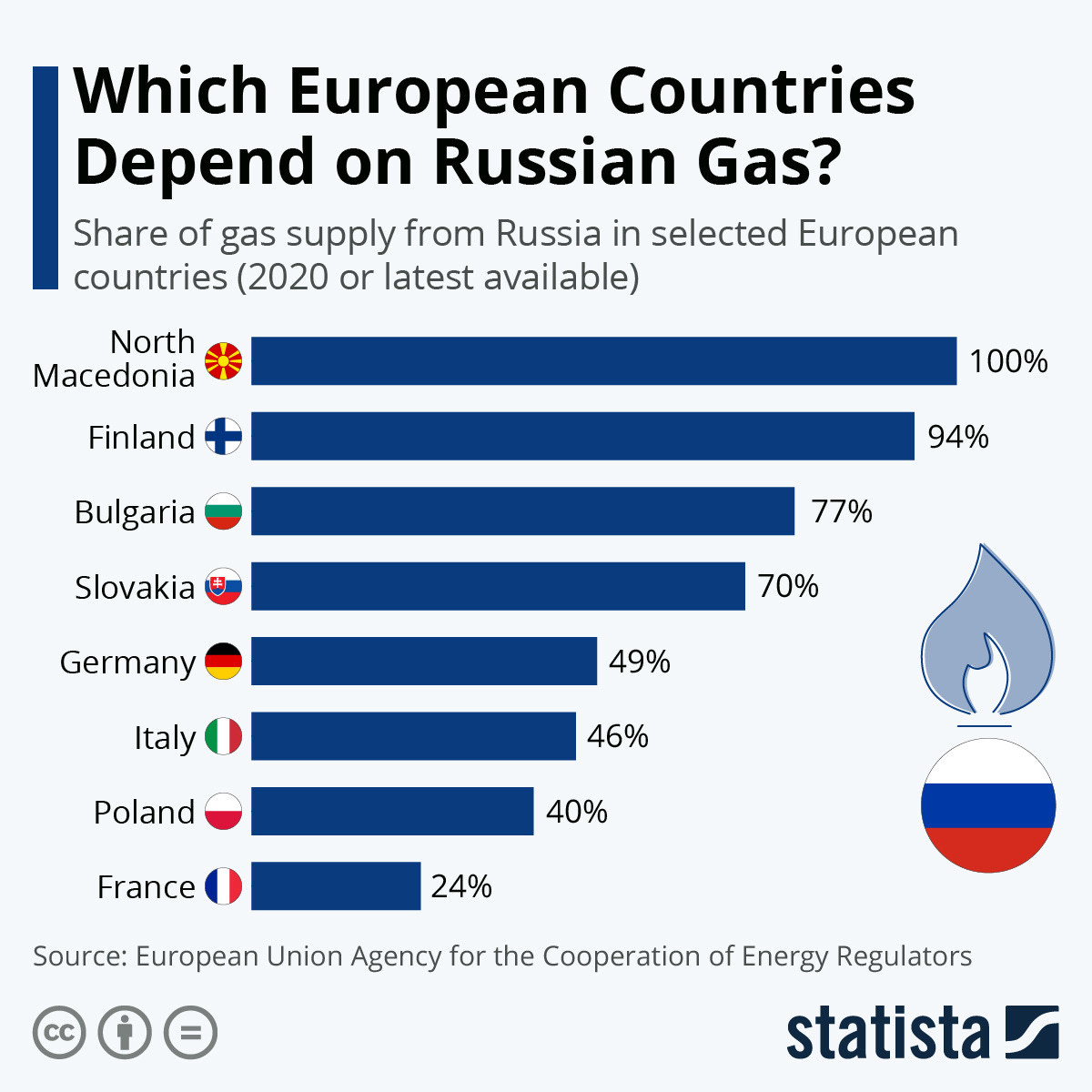

There are four main countries that purchase the majority of Russia’s crude oil: The Netherlands, Germany, Poland, and Belarus. In 2017, these four countries accounted for seventy percent of the total export volumes. Other countries that have some of the largest exports in 2020 included Italy, Finland, and Slovakia.

Russia is also one of the world’s largest gas exporters. The countries in Europe that receive the highest percentage of their natural gas from Russia include, North Macedonia (100 percent), Finland (94 percent), Bulgaria (74 percent), Slovakia (70 percent), Germany (49 percent), Italy (46 percent), Poland (40 percent), and France (24 percent).

Russia is the world’s largest supplier of wheat, and together with Ukraine accounts for 29% of the global wheat trade and nearly 20% of the global corn trade. In response to Western sanctions on Russia, China has relaxed restrictions on imports of Russian wheat. This agreement provides Russia with a secure buyer at a time when exports to other countries might be complicated by financial sanctions or other disruption.

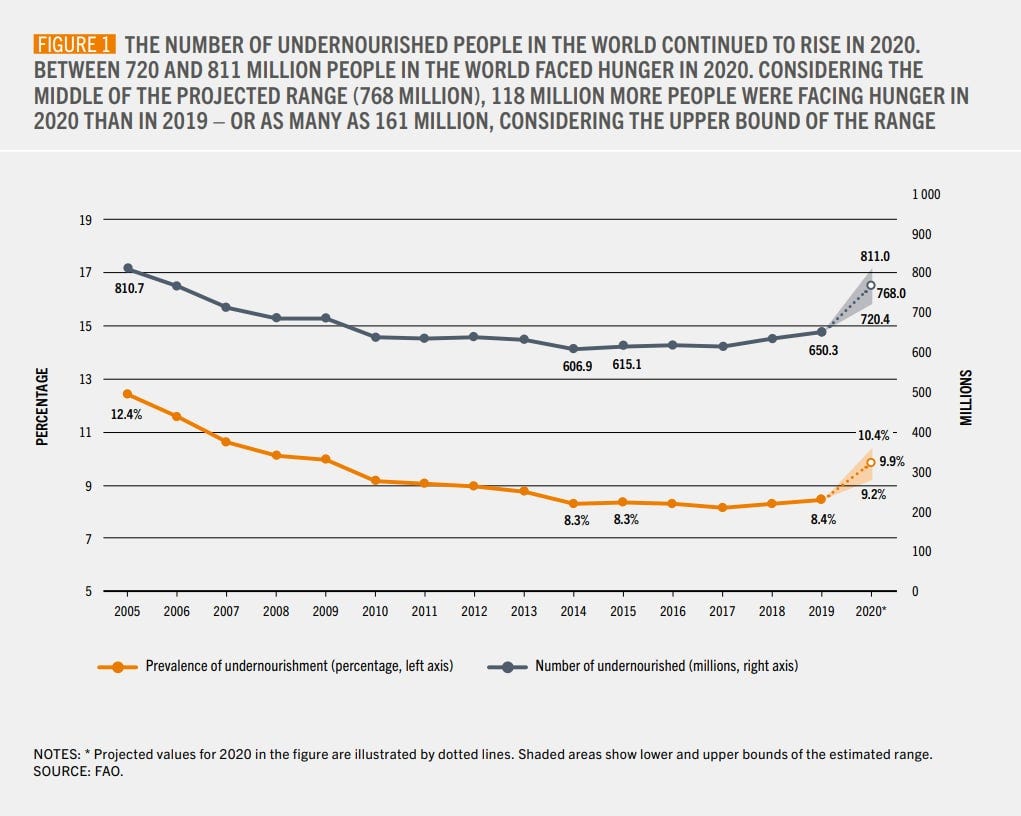

In 2020, global lockdown policies already pushed as many as 150 million into starvation reversing fifteen years of malnutrition trends. As Stanford Professor of Medicine, Dr. Jay Bhattacharya said, “Millions more will die from collateral damage from lockdown than from lives saved by it.” In a similar sense, war and economic sanctions on Russian energy, food, and fertilizer will do the most collateral damage to the poorest populations in the world.

Consequently, the United States and Europe cannot sanction Russia’s oil and gas industries, unless they want to face a massive inflationary crisis that pushes energy prices through the roof in their own countries. Without Russian oil, gas, and wheat, Europeans will suffer a cold and hungry winter.

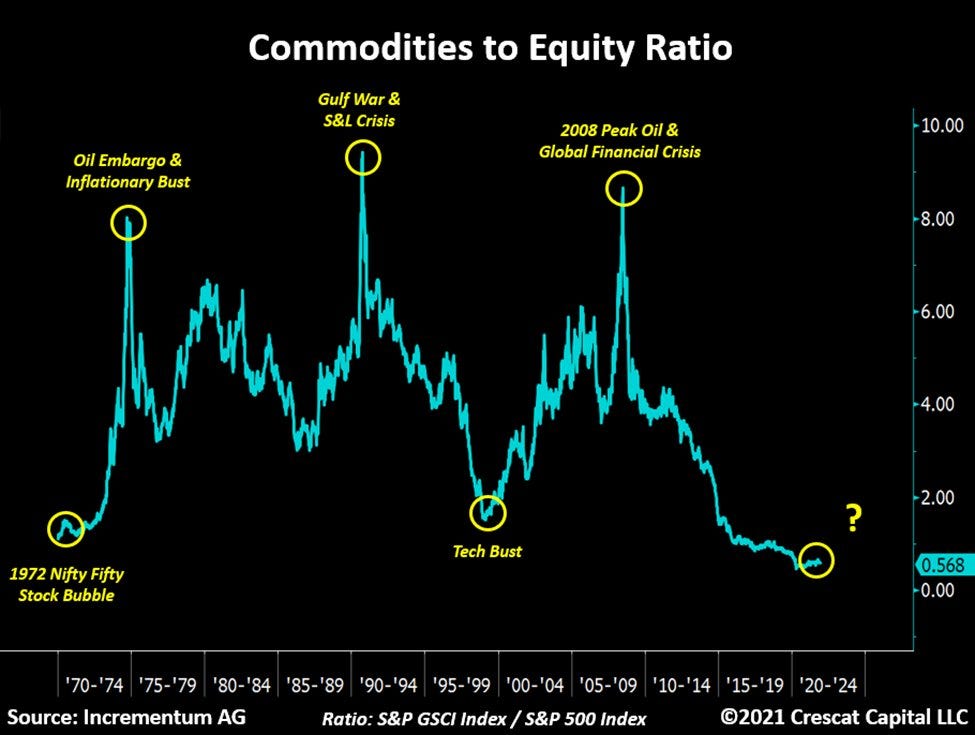

With Russia’s economy depending heavily on the price of gas, oil, and commodities, Putin may have tactically assessed that the global market is at the turn of a commodities supercycle (commodities increasing in price and historically undervalued to equities), and decided that his economy could manage the sanctions if his invasion led to price increases in the commodities that his country depends upon.

As recently as November 16, 2019, Vladimir Putin said, “The Dollar enjoyed great trust around the world. But, for some reason, it is now being used as a political weapon to impose restrictions. They’ll collapse soon. Many countries are now turning away from the Dollar as a Reserve Currency.”

Thanks to the incompetence of U.S. and E.U. policymakers, western nations have foolishly dismantled their own energy independence in exchange for Russian oil and gas. As a consequence, Russia and China have invaded Ukraine with the ultimate goal of sparking increased inflation in the west, increasing the cost of food and energy, and speeding up the global process of de-dollarization.

This comes after the Federal Reserve doubled its balance sheet over the last two years, inflation hit 40-year highs, and U.S. government debt exceeded $30 trillion for the first time. Vladimir Putin and Xi Jinping feel emboldened by a Biden administration that shut down U.S. energy independence, abandoned Afghanistan in chaos, and created the highest inflation in 40-years.

They are not threatened by a Chairman of the Joint Chiefs of Staff who still sits in his position after he admitted in front of Congress that he would give his Chinese counterpart a heads up if the United States ever launched an attack. They may even have more control over the situation than anyone is aware of considering the Bank of China and other Chinese state-controlled banks gave $1.5 billion to an investment fund owned by the son of Joe Biden.

THE DOWNLOAD:

Revolver | The Truth About the Ukraine: A diplomatic solution with Russia might have involved something as simple as demilitarization in Ukraine and a signed treaty promising Ukraine would never join NATO. Again and again, interventionism has led America into avoidable and humiliating catastrophes. Belligerent neocons and neoliberals of American foreign policy have always been wrong. It led to disaster in Vietnam, an embarrassment in Iraq, and total national humiliation in Afghanistan. The War Party destroyed Syria and Libya as stable countries and turned them into hotbeds of chaos and terrorism, in return for absolutely nothing. Do not let them pursue a position of maximum aggression against nuclear armed Russia. Read more.

Lee Smith | Ukraine’s Deadly Gamble: For nearly two decades, the U.S. national security establishment under both Democratic and Republican administrations have used Ukraine as an instrument to destabilize Russia, and specifically to target Putin. Why can’t the American security establishment shoulder responsibility for its role in the tragedy unfolding in Ukraine? Because to discuss American responsibility openly would mean exposing the national security establishment’s role in two separate, destructive coups. Beginning with the 2013-14 Obama administration-backed coup that toppled a Russia-friendly government in Kyiv followed by Ukrainian political figures gladly joining in the Russian collusion narrative targeting Donald Trump. Read more.

Russia Ukraine War And Global Macro Impacts With Luke Gromen: Preston Pysh talks with Luke Gromen about Luke’s overview of the macro landscape since the Russian invasion of Ukraine, the ulterior motives of Vladimir Putin and Xi Jinping, and much more. The conversation covers a wide range of topics including cyber warfare, commodities prices, and what role Bitcoin plays in the ongoing economic sanctions. Listen here.