As many U.S. farmers anxiously await spring planting, supply chain concerns continue to plague planting outlooks. And while weather typically has the final say in what farmers plant, input availability issues could be another factor farmers battle all spring.

USDA’s Prospective Plantings report shows farmers intend to plant 4% fewer acres in 2022, largely due to fertilizer prices. However, it’s chemistry availability that seems to be a growing concern for both ag retail suppliers and farmers. Commodity and input prices have seen a dramatic change since the USDA survey was done at the beginning of March. And if farmers decide to switch acres last minute, finding the necessary inputs may be the biggest hurdle this year.

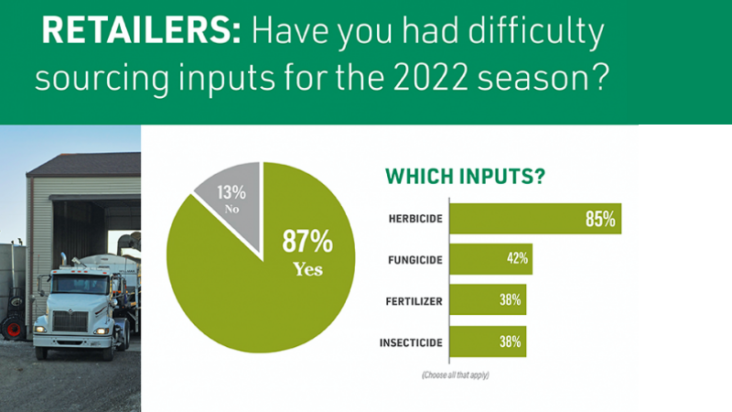

Farm Journal recently conducted a survey of ag retailers, and it found 87% of retailers say they have had difficulty sourcing inputs this year. And of those who are having trouble with input availability this year, 85% say herbicides are the biggest problem. The next biggest concern is with fungicide as 42% of retailers surveyed say they’ve seen issues with that input. 38% of respondents reported fertilizer supply problems.

The Farm Journal survey also drilled down further into the chemistry supply concerns. Ag retailers say glyphosate is the biggest concern at this point in the year.

Glyphosate production was hammered with several black swan events this year. Ripple effects of COVID-19 in China caused issues in sourcing the active ingredients in glyphosate. Then, Hurricane Ida hammered the Gulf Coast, with the largest glyphosate plant in the U.S. taking a direct hit. The Bayer facility, which supplies the majority of glyphosate in the U.S., was offline for more than six weeks last fall. And then another issue spurred supply concerns this year, as Bayer declared a Force Majeure after a supplier of an ingredient for its widely used herbicide glyphosate ran into a mechanical failure, which Bayer said could hamper the output of the product.

“Our supplier is on track to restore production, (and) we’ve sourced additional materials and made other mitigation efforts to help best manage this situation,” the company said in a statement reported by Reuters.

The same Farm Journal survey found retailers have 50% to 99% of their needed inventory of inputs for this crop year currently in house, with 50% of those respondents saying overall inventory sits at 75%-99%. But it’s a supply chain headache that many ag retailers are having to manage by the day, as Helena’s CEO says the company has never seen a year where supply chain disruptions have been this severe.

“Supply situations change literally weekly, daily, monthly for us,” says Eric Cowling, President and CEO, Helena Agri Enterprise. “So there’s times I feel like we’re in really good position, and the next day you feel like you’re out of position. So, I think it’s just an ongoing market dynamic where you’re to the point when you’re in the field first, that’s where the first needs really take place from a Helena perspective.”

Movement of Inputs in Trouble

Logistics is another issue retailers are navigating. From a shortage of truck drivers to now rail issues hindering movement of product, CHS says delivery times have increased 20%.

Farm Journal’s Washington Correspondent Jim Wiesemeyer reported earlier this week that the Biden administration is already planning on asking railroads to accelerate the delivery of fertilizer supplies.

“Sources say fertilizer supplies are out there in the countryside. The big attention will be on the eastern Corn Belt where they didn’t get as much fall fertilization done due to moisture. And the planting window is not going to open nearly as quickly in the eastern Belt (and west) as it did last year,” says Wiesemeyer.

Growing Concerns

The latest CME/Purdue Ag Economy Barometer found the biggest concern among producers continues to be “higher input costs”. The Barometer found disruptions to trade in ag commodities and key inputs such as fertilizer is growing due to the war in Ukraine. The Survey found 19% of respondents chose “availability of inputs” as their biggest concern, matching the percentage of producers who chose “lower crop and/or livestock prices”.

Those concerns are weighing heavily on producers, as the overall, the Ag Economy Barometer posted the weakest farmer sentiment reading since May of 2020. With a reading of 113 in March, sentiments showed a 12-point drop in just a month.

The Issue Could Linger into 2023

As ag suppliers navigate the supply chain issues, there’s no easy fix. Bayer says input availability could be a problem for agriculture through 2023.

“I believe that you will continue into probably the 2023 season,” says Jackie Applegate of Bayer. “I just think a little bit is also that whole lag of COVID and the pandemic. So, I would say probably through the ’23 season will be still working through probably some of those elements. And but I’m I have I’m optimistic that ‘24 will be back to normal. ”

Growers all across the U.S. are now coming up with multiple plans for this year, not knowing what inputs won’t make it to their farm in time for the 2022 planting season.